Every Thursday morning at 7am I join Tom Egelhoff on his local talk radio show to discuss financial events, money tips, and field live questions (1450am /kmmsam.com). Recently, I was asked by a caller what I believe the most common mistake investors make in their retirement portfolios is? After disclaiming all responsibility for my advice and it’s possible outcome, I replied that I believe many people are not taking enough risk in their retirement portfolios. I usually want people to consider their retirement accounts as their highest risk asset, owning more stock and less ‘other stuff’ in their IRA’s, 401k’s and other qualified assets.

My reason is that retirement money is designed for long-term growth by the tax advantages it receives. By taking more risk, over the long term there should be more growth, and therefore the tax deferral has a greater benefit. Such risk should be offset by other strategies (like holding cash and paying down debt) to ensure that your overall financial condition it true to your tolerance. But, two things are clear: average lifespans are extending; and if you avoid risk, you will usually also avoid reward.

My reason is that retirement money is designed for long-term growth by the tax advantages it receives. By taking more risk, over the long term there should be more growth, and therefore the tax deferral has a greater benefit. Such risk should be offset by other strategies (like holding cash and paying down debt) to ensure that your overall financial condition it true to your tolerance. But, two things are clear: average lifespans are extending; and if you avoid risk, you will usually also avoid reward.

So far in 2020, the outlook is calling for continued gains in stock and real estate investments despite the backdrop of coronavirus, trade ‘bickerments’, and an election that is sure to offend everyone somehow. My personal view is that we are currently beyond fair value, but not yet at ludicrous values. If we can help you or someone you care about, feel free to call.

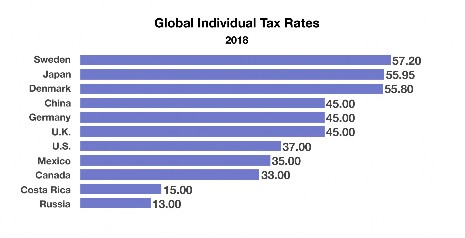

Relative to other countries, U.S. income tax rates are considered low. Imposed tax rates vary from country to country depending on the country’s tax base, overall government expenditures and social programs offered. Public and social programs including healthcare and education, as well as the demographics of a country’s taxpayers, also contribute to tax rates.

Scandinavian countries have historically maintained higher tax rates in order to subsidize the various social programs offered to its citizens. Sweden and Denmark both have tax rates for individual taxpayers in excess of 55%. Other countries not offering similar social programs such as Russia and Costa Rica, impose lower rates. Costa Rica has become a beacon for some people partially because of its climate and 15% tax rate. (Source: Tax Policy Center, OECD; https://stats.oecd.org

Scandinavian countries have historically maintained higher tax rates in order to subsidize the various social programs offered to its citizens. Sweden and Denmark both have tax rates for individual taxpayers in excess of 55%. Other countries not offering similar social programs such as Russia and Costa Rica, impose lower rates. Costa Rica has become a beacon for some people partially because of its climate and 15% tax rate. (Source: Tax Policy Center, OECD; https://stats.oecd.org

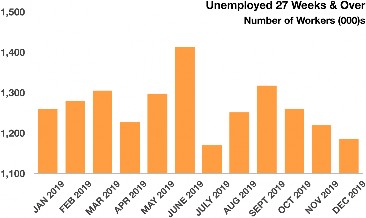

Unemployment Periods Lasting Less – Labor Market Update

Workers are spending less time unemployed according to data compiled by the Department of Labor. The number of workers that are unemployed for a period of 27 weeks or more fell to 1,186,000 in December 2019. The data reveals that workers are finding jobs quicker and that companies are hiring at a faster pace.

Unemployment time has been consistently decreasing since September 2019, a positive observation as noted by economists. A 50-year low for the unemployment rate has contributed to shortened unemployment periods for workers, as demand for skilled labor has gradually increased.

Unemployment time has been consistently decreasing since September 2019, a positive observation as noted by economists. A 50-year low for the unemployment rate has contributed to shortened unemployment periods for workers, as demand for skilled labor has gradually increased.

(Source: Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily

The Secure Act – Key Provisions Affecting Retirement & College Savings Plans

Retirement plan legislation passed by Congress effective 2020 includes changes affecting millions of American retirees. The Setting Every Community Up For Retirement Enhancement Act, known as the Secure Act, was signed into law by the president on December 20th.

Inherited IRAs / Stretch IRAs

Rules surrounding the distribution of funds from an Inherited IRA have changed by accelerating the distribution and taxation of Inherited IRA funds going to non-spouses. Those most affected by the new rules are retirees with generous IRA balances intending to leave funds to their children and grandchildren. Also referred to as Stretch IRAs, Inherited IRAs have allowed IRA beneficiaries to stretch distributions and taxes over an extended period of time.

A current rule that will remain the same is allowing a spouse to rollover their deceased spouse’s IRA to a spousal IRA and take Required Minimum Distributions (RMDs) based on their life expectancy. Inherited IRA rules will be modified by the newly imposed rules affecting non-spousal beneficiaries such as children and grandchildren, the most common types of inherited IRA beneficiaries, who will be required to distribute the entire balance within 10 years, rather than “stretching” the distributions out. A challenge for inherited IRA beneficiaries is the tax implication of accelerated distributions over a much shorter time period. Some beneficiaries may also run the risk of falling into a higher tax bracket, especially if they are working.

Traditional IRAs

The 70 1/2 age limit for Traditional IRA contributions has been repealed, meaning that as long as you have earned income from working, you may contribute past age 70 1/2. The repeal is applicable to contributions made for tax year 2020 and thereafter, not for tax year 2019.

RMDs

The required minimum distribution (RMD) age for IRAs has been raised to 72 from 70 1/2. The new RMD age applies to those who turn 70 1/2 after December 31, 2019.

401(k) Plans

Small businesses are encouraged to set up plans for their employees by increasing the cap under which employees are automatically enrolled in a plan at 15% of wages. Part-time employees who work either 1,000 hours annually or have three consecutive years with 500 hours of service are eligible for a 401(k) plan. Annuities will now become an option for employees taking retirement distributions from their 401(k) plan, providing consistent income similar to how pension plans used to decades ago.

529 Plans

Qualified student loans may be repaid with 529 plan assets up to a maximum of $10,000 annually. Parents may also use 529 assets for the birth or adoption of a child, up to $5,000 per year. (Source)

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $3 to $12 Million. Go outside, we’ve got this.