Dear Friends, this may not be the bottom, but this is what it feels like,

It has been a dismal year for market investors. Year to date both stocks AND bonds are down about 24% (as of this writing)! The only safety that feels good is cash and that just lost 9% to inflation. The losses are painful and confusing. Additionally, we are fearful of more pain with every election, natural disaster, oversees conflict, and monthly statement. Warren Buffet says to be greedy during these times. But before that can happen, we first need to stop being fearful of tomorrows uncertainty.

I’m always reminding myself that economics and finance are social sciences and not exact sciences. Markets are more like wild rivers than equations and the only rule is that there are no smooth rides or straight lines. As soon as someone has figured out which way we are going, the rules change. But eventually perseverance is rewarded, markets will return to fair value, and it will happen probably in unexpected ways. American Capitalism will reward risk, we just don’t know when. Fear demands action, prudent investing requires discipline.

I’m always reminding myself that economics and finance are social sciences and not exact sciences. Markets are more like wild rivers than equations and the only rule is that there are no smooth rides or straight lines. As soon as someone has figured out which way we are going, the rules change. But eventually perseverance is rewarded, markets will return to fair value, and it will happen probably in unexpected ways. American Capitalism will reward risk, we just don’t know when. Fear demands action, prudent investing requires discipline.The one rate to rule them all – The Fed Funds Rate, which is controlled by the Federal Reserve Board, is the interest rate at which banks charge each other to borrow money. This year, the Fed has continued to aggressively increase the rate.

The effects of increasing the Fed Funds Rate are more expensive borrowing costs and reduced demand for borrowing money. By increasing the rate, the Fed hopes to pacify rising inflation, as the U.S. is currently experiencing the highest inflation rate observed since 1981.

In March of this year, the Fed began its increase of interest rates. Before then, the rate was effectively at close to 0% between April 2020 and February 2022. As of September 21st, the rate has a target range of 3% to 3.25%, which means the rate has risen 3% in just 7 months. This is the largest

In March of this year, the Fed began its increase of interest rates. Before then, the rate was effectively at close to 0% between April 2020 and February 2022. As of September 21st, the rate has a target range of 3% to 3.25%, which means the rate has risen 3% in just 7 months. This is the largestincrease made by the Fed in a single year since 1982. Based on this, the Fed Funds Rate would reach 4% to 4.25% by the end of the year. (Sources: Federal Reserve Bank of St. Louis, Federal Reserve Bank of New York)

Stocks Endure Difficult Third Quarter – Domestic Equity Overview

Equities across the board were down in the quarter ending September 30th, as the market continues to react to global turmoil and the Fed’s aggressive interest rate spikes. Sectors that held up the best relative to other sectors included biotechnology, healthcare services, and oil/gas, joined by banks, semiconductors, and healthcare equipment.

Various equity analysts believe that the current rallies in equities are bear market rallies with little or no fundamental strength. Optimistically, certain sectors are establishing more attractive valuations as prices have receded.(Sources: S&P, Dow Jones, Bloomberg)

Short-Term Bond Rates Remain Higher Than Long-Term Bond Rates – Fixed Income Review

Rising rates are being compounded by the Fed’s suspension of buying U.S. Treasuries and mortgage bonds on the one market. Along with the Fed’s current increase in short-term rates, the additional pressure on the fixed-income market has exacerbated the rapid rise in interest rates.

Short-term Treasury bond yields remained higher than longer-term maturities in September, known as an inverted yield curve. The 2-year Treasury yield finished September at 4.22% while the longer-term 10-year Treasury yield was at 3.83%.(Sources: U.S. Treasury, Bloomberg, Federal Reserve)

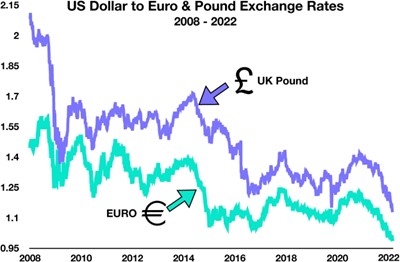

Euro and Pound Plummeting – Spring Break Ideas

The European economy is currently experiencing turbulence due to the Ukrainian conflict and Russian supply cuts. On the other hand, high-interest rates have increased the strength of the U.S. dollar, resulting in historical lows in the exchange rates of the U.S. Dollar to European currencies.

2022 marked the first time the U.S. Dollar hit parity, or equal value, with the Euro since 2002. The Euro’s peak value was in April of 2008 when one euro was equal to 1.6 dollars. However, the aforementioned economic turbulence in Europe has started a recent decline in the euro’s valuation, which sits at around one euro equal to 0.97 dollars.

A more drastic decline can be seen in the dollar and the British pound exchange rate. The pound saw a peak of around 2.1 dollars equal to one pound in November 2007, yet has lost nearly half its value in the approximately 14 years since. Currently, the pound is equal to 1.09 dollars, nearly a 50% decline from this peak to the current valuation.

A more drastic decline can be seen in the dollar and the British pound exchange rate. The pound saw a peak of around 2.1 dollars equal to one pound in November 2007, yet has lost nearly half its value in the approximately 14 years since. Currently, the pound is equal to 1.09 dollars, nearly a 50% decline from this peak to the current valuation.

These exchange rates not only highlight the turbulence in European economies but also the growing strength of the U.S. Dollar. The dollar has historically grown stronger in times of global recession and war, which is currently the case as well. Many European goods are much relatively cheaper now for Americans, which could remain for months or even years. (Sources: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis)

Housing Affordability / Series 1 of 2: Rising Mortgage Rates Deter New Buyers – Housing Overview

The 30-year conforming mortgage rate has a profound effect on the prices of homes and the rate at which interest is collected on mortgages. This rate is increasing, which has an inverted effect on home prices, causing them to drop for the first time in over a decade.

Between July and June of 2022, home prices experienced their first monthly drop since March of 2012. This ended a decade-long surge of rising home prices by falling to -0.44% from June to July of 2022. The cause of this is high mortgage rates.

Between July and June of 2022, home prices experienced their first monthly drop since March of 2012. This ended a decade-long surge of rising home prices by falling to -0.44% from June to July of 2022. The cause of this is high mortgage rates.Mortgage rates, as of late September 2022, have reached 6.7%. This is the highest they have been in over 16 years and have not reached this level since July 2006. When mortgage rates are at such high levels, they can deter new homebuyers, as potential buyers do not want to purchase a home on which they have to pay such high interest. Thus, sellers are forced to drop their home prices to look more favorable to buyers, but such high mortgage rates still end up making most houses more expensive than they were months ago when home sale prices were relatively higher.

Currently, 66% of Americans are homeowners, which is down from 2004 highs of nearly 70% but still on the rise from 2016 lows of 63%. However, these mortgage rates are expected to drop the homeownership rate yet again as an increasing amount of potential buyers are dissuaded from purchasing a home now and instead look to rent and wait until mortgage rates drop. (Sources: U.S Census Bureau, S&P Dow Jones Indices, Freddie Mac, Federal Reserve Bank of St. Louis)

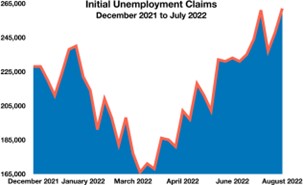

Unemployment Claims On The Rise – Labor Market Overview

Unemployment claims reached their highest level since late November 2021, and have steadily increased throughout the year. As of the week ending on August 6th, the job market saw initial unemployment claims rise to 262,000. This was an increase of 14,000 claims from the previous week’s 248,000 claims and an increase of over 30,000 claims from just 6 weeks prior. This gradual increase in unemployment claims is emerging as uncertainty over the economy expands. Many sectors, specifically tech and real estate, are

experiencing stagnated hiring and even layoffs.

With a volatile stock market and a slowing economy, technology companies are easing and even freezing hiring and in some cases conducting layoffs. Optimistically, layoffs are not at the high levels they were during the pandemic, but unemployment claims have been steadily increasing. This could foreshadow more uncertainty in an economy that has begun to slow down. (Sources: U.S. Employment and Training Administration, Federal Reserve Bank of St. Louis)

With a volatile stock market and a slowing economy, technology companies are easing and even freezing hiring and in some cases conducting layoffs. Optimistically, layoffs are not at the high levels they were during the pandemic, but unemployment claims have been steadily increasing. This could foreshadow more uncertainty in an economy that has begun to slow down. (Sources: U.S. Employment and Training Administration, Federal Reserve Bank of St. Louis)The 12th Annual Bozeman CPA Symposium is ON! If you are an accounting professional, please join us at the GranTree on Thursday, Nov 10th for a great afternoon of quality CPE from local experts. Email mike@mccormickfinancialadvisors.com for more information to reserve your seat. (Participating state boards of accountancy have final authority on the acceptance of individual courses for CPE credit.)

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $5 to $30 Million. Go outside, we’ve got this.