Dear Friends,

Many pundits are claiming that investors are in for tough sledding in the future. After many years of watching the prices of most everything go up, they may now be reaching their limits. In fact, corporate bonds have already incurred a gut punching ~12% loss year to date! Since the bond market is about 10x the size of the stock market, this is significant news and will have wide effects on all investments. Stock market sector returns have run the gamut from Oil and Commodities (+28%), to Consumer Staples (+2%) all the way down to poor Zuckerberg and his ‘Meta Mess’ (-34%). In contrast, real estate prices have by-passed ‘Bananas Valuations’ and are now moving towards ‘Funny Money’. However mortgage rates have also increased significantly, and sadly that portends even more buyers may now be priced out of home ownership. Things are happening quickly and people are making financial decisions emotionally.

Inflation is real, and will erode cash. Rates are rising and will continue to put downward pressure on bonds and leveraged investments. This is a poor time to make a financial error. Sitting tight and watching is a fine stance for now, but only for so long.

In particular, I’m watching for a decrease in demand as opposed to the increase in supply that has been hoped for. It should be unusual for us to see bare shelves at the grocery store, closed restaurants due to staffing shortages, and homes going for 20% above asking prices. But we have gotten to become comfortable with it. This is what happens after years of liquidity being put to the people and consumption runs unchecked. The rally cry that we need more supply of (insert your desire here) is dangerous, unsustainable and has become inflationary. The Fed agrees and has begun to impose the more healthy option to aggressively raise rates and reduce its balance sheet. Don’t fight the Fed.

As Jim Cramer says, ‘There is always a bull market somewhere” and new opportunities are presenting themselves thanks to higher interest rates and risk repricing. Careful stock selection, diverse portfolios, and discipline will continue to outperform fear based decisions. If it wasn’t a bit scary right now I’d be more concerned.

Statistically, it was my turn.

Statistically, it was my turn.

Well, I finally got ‘it’. After 2 years of somehow evading COVID, it finally caught up with me. While my symptoms are mild, they are persistent. How ironic that I had flippantly declared the pandemic ‘over’ last week! So yes, the pandemic is apparently still on and we are now learning to live with it. More painful is living with the images coming from Ukraine and feeling helpless. The US economy is still strong, the markets are functioning fairly, and wherever we end up, we will certainly overcorrect on the way there. These are icy roads we are traveling indeed

Stocks Have A Tough First Quarter – Equity Overview

The yield on the 10-year Treasury bond rose above the S&P 500 Index yield in March, meaning that the 2.32% yield on the 10 year Treasury bond is more than the 1.32% dividend yield for the S&P 500 Equity Index. Some analysts believe that current earnings estimates for the S&P 500 Index, which represents a wide swath of the equities market, may be distorted. Almost all of the growth in 2022 earnings for the index since the beginning of the year can be traced to the energy sector alone. The dramatic rise in oil and energy prices have propelled profits for oil and energy companies, which aren’t representative of other sectors.

Major equity indices recouped some ground in March, with the S&P 500 Index , Dow Jones Industrial Average and the Nasdaq all having a positive month. First quarter returns were not as generous, as all three indices saw negative performance with the worst quarter in two years. Some analysts are skeptical if an upward trajectory will continue, while others see fundamental optimism surrounding earnings and economic growth, both of which affect stock prices. (Sources: S&P, Treasury, Dow Jones, Nasdaq)

Rates On The Rise – Tougher start for Fixed Income

Global bond yields rose in March as European and Asian central banks concurrently raised rates to help stifle global inflation. The Fed began to raise rates in March, with its first of perhaps six additional increases this year. Even though the increases are minimal, each increase affects the overall bond market. Treasury and corporate bond yields rose following the Fed’s move, with the anticipation of a continued higher rate environment towards the end of the year.

Shorter term Treasury bonds have begun to yield more than some longer term Treasury bond maturities. Known as an inversion, economists and bond analysts view such a dynamic as indicative of a recessionary environment sometime in the future. (Sources: Treasury, Federal Reserve)

Women Getting Bigger Pay Raises Than Men – Labor Market Good News!

The pandemic derailed many working families, keeping family members home with children as schools and daycares were shuttered. Many mothers stayed home to care for children and other family members, with many even leaving their jobs. Data from the Atlanta Federal Reserve found that women have been seeing higher wage increases than men over the past few months.

Wages for females were up 4.4% from a year earlier versus a 4.1% increase for men during the same period. The February data marks six consecutive months that female wages have outpaced male wages, a dramatic deviation from traditional trends. The data also found that women switching jobs are also seeing larger pay increases than men switching jobs. Women are also more likely to work part-time

Wages for females were up 4.4% from a year earlier versus a 4.1% increase for men during the same period. The February data marks six consecutive months that female wages have outpaced male wages, a dramatic deviation from traditional trends. The data also found that women switching jobs are also seeing larger pay increases than men switching jobs. Women are also more likely to work part-timethan men are, thus having more flexibility in planning for family and personal time. (Sources: Dept. of Labor, Atlanta Federal Reserve; Labor Report First Look)

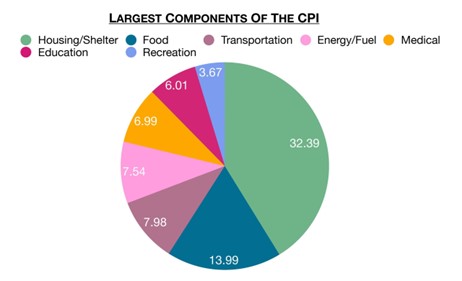

Food and energy have become the two fastest rising expenses for consumers nationwide, as well as representing a larger proportion of total living costs. Currently, 21.5% of the Consumer Price Index (CPI) is composed of food and energy expenditures, where the cost of groceries alone were 6.5% higher and the price of gasoline 50.8% higher than a year ago.

The concern that many economists have identified is that as millions of Americans are spending more on food and energy, they have less to spend on what they’d truly desire or want, also known as discretionary goods. As funds for discretionary items become scarce, economic growth suffers as sales of cars, furniture, clothing, and dining out become less affordable for millions of consumers.

Historically, food and energy prices have always been very volatile, making up more or less of consumer

expenditures over time. Where consumers live and how old they are also dictates how influential

components of the CPI are. Gasoline for example is less expensive in Oklahoma than in California, and

seniors may not spend any funds on education but may spend more on medical expenses. (Sources: Dept.

of Labor, BLS)

What Is Stagflation – Inflation Overview

Becoming more of a topic throughout the financial media is stagflation, characterized as an environment with minimal economic growth, inflation, and elevated unemployment. The last time the U.S. experienced stagflation was in the late 1970’s and early 1980’s, with only a small portion of consumers remembering what it was like.

Many economists believe that the inflation we are experiencing today is driven by supply constraints and not driven by heightened consumer demand. Traditional periods of inflation have always evolved from excessive consumer demand supported by expanding wages. Currently, wages are not keeping up with inflation, thus producing diminishing incomes and consumer purchasing power.

Should wages fail to keep up with inflation, and economic growth begin to falter, then the risk of stagflation increases. Unemployment may increase concurrently should companies decide to reduce staff and cut positions as an economic slowdown sets in. (Source: Federal Reserve Bank of Kansas City)

we are here to help you and the people you care about! I regularly field calls from referred friends and associates, helping them navigate questions about money. Part of my practice is designed to help people that are not clients of ours. These are tricky times and everyone can benefit from a second opinion or another viewpoint on a tricky financial decision. It’s not sales, it’s people helping people. 406-920-1682.

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $5 to $30 Million. Go outside, we’ve got this.