Dear Friends,

Whew, 2022 is behind us! Looking back upon last year it seems that everyone suffered financially to some degree. Bonds and stocks were both down about -18%. An aggressive small cap tech portfolio got taken to the woodshed with losses over -40%. Utilities and commodities/energy were the only places to hide (other than cash). And once again, no one got it right. In hindsight, inflation was the culprit, finally showing up from all these years of free money. But we made it through. In fact, the unlikely “soft landing” scenario may be happening and I’m actually feeling optimistic about your investments.

But any good news about unemployment and moderating inflation is already being drowned out by new threats. One such new terror I’ve been exploring is artificially intelligent programs that can write papers for students, provide relationship tips, and also give basic financial advice. It’s not something most of us can understand how it works, but it does! Does this stress you out? I asked ChatGPT How to reduce stress about money? This is what I received:

But any good news about unemployment and moderating inflation is already being drowned out by new threats. One such new terror I’ve been exploring is artificially intelligent programs that can write papers for students, provide relationship tips, and also give basic financial advice. It’s not something most of us can understand how it works, but it does! Does this stress you out? I asked ChatGPT How to reduce stress about money? This is what I received:

- Make a budget: Having a clear understanding of your income and

- expenses can help you feel more in control of your finances.

Set financial goals: Setting specific, measurable, and achievable financial goals can give you a sense of purpose and direction. - Caveman with a cell phone running from a Sabretooth Tiger by Dall-e Artificial Intelligence

- Create an emergency fund: Having a savings cushion can provide a sense of security and reduce stress caused by unexpected expenses.

- Seek professional advice: Consult with a financial advisor or therapist to help you understand and manage your stress about money.

- Practice mindfulness: Mindfulness can help you focus on the present moment and reduce stress caused by worries about the future or regrets about the past.

- Prioritize self-care: Make sure to take care of yourself physically, emotionally, and mentally. This can help reduce overall stress levels, including stress about money.

- Learn to manage stress: Stress management techniques, such as exercise, meditation, and deep breathing, can help you feel more relaxed and better able to manage stress about money.

It’s also important to remember that money is a means to an end, not an end in itself. Being content with what you have, and focusing on the things that really matter in life, such as relationships and personal fulfillment, can help reduce stress about money. (OpenAI.com)

Take care in 2023. I hope it’s the best ever! Why shouldn’t it be? -Mike

Last year reminded us that markets can go down

The rising prices of everything from homes to stocks to bitcoin finally got to be more than what markets could bear. In 2022 we began to reset valuations and it wouldn’t be surprising to see more pullbacks. One of the indicators I pay attention to is the Yield Curve, which in a normal market defines how the cost of borrowing money increases with the amount of time before it must be paid back. Currently, it is actually less expensive to borrow long than short.

Short Term Rates Remain Higher Than Long Term Rates – Fixed Income

40-year highs in inflation and Federal Reserve rate hikes played havoc on bonds throughout 2022, sending short and long terms rates to levels not seen in years. Short-term rates remained higher than long-term rates at the end of 2022, indicating a continued inverted yield curve. The 10-year Treasury note yield started 2022 at 1.52%, peaked at 4.25% on October 24th, and closed the year at 3.88%. The three-month Treasury bill rate, thanks to the Fed’s continuous increase of short-term interest rates to alleviate inflationary pressures, started the year at 0.06% and closed the year at 4.42%. (Sources: Federal Reserve, U.S. Department of the Treasury)

Tax Changes For 2023 – Tax Planning

In 2022, inflation eclipsed 9% and reached 40-year highs as food and gasoline prices exhibited continuous spikes. Many consumers reported consistently feeling that their paychecks did not go as far as they used to, to which the Internal Revenue Service (IRS) has responded by implementing key changes for the tax year 2023. In 2023, inflation adjustments look to match the burdens created by inflation and the decrease in real wages exhibited in 2022. For marginal income taxes, all rates remain the same but now higher income amounts are taxed at lower levels. For example, while the top tax rate is still 37%, it applies to any individual income greater than $578,125 rather than the previous threshold of $539,900.

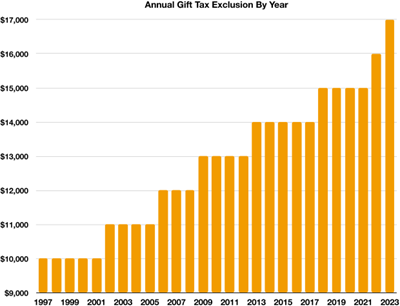

Standard deductions have increased to $27,700 for married couples in 2023, up $1,800 from 2022. The annual gift tax exclusion is up to $17,000, with 2023 being the first year the exclusion will rise only one year after it was previously increased since the exclusions inception in 1997. Itemized deductions continue to have no limitation since 2018, and the estate tax exclusion amount for 2023 will be $12,920,000, nearly $900,000 greater than in 2022. Taxes reflecting these changes will be filed in early 2024, yet will apply for the tax year 2023. (Source: Internal Revenue Service)

Standard deductions have increased to $27,700 for married couples in 2023, up $1,800 from 2022. The annual gift tax exclusion is up to $17,000, with 2023 being the first year the exclusion will rise only one year after it was previously increased since the exclusions inception in 1997. Itemized deductions continue to have no limitation since 2018, and the estate tax exclusion amount for 2023 will be $12,920,000, nearly $900,000 greater than in 2022. Taxes reflecting these changes will be filed in early 2024, yet will apply for the tax year 2023. (Source: Internal Revenue Service)Highlights From The SECURE Act 2.0 – Retirement Planning

In response to an aging American population, a bipartisan retirement measure passing through Congress looks to assist Americans nearing retirement in the next decade. The measure, titled Secure Act 2.0, builds upon previous changes to retirement policies in 2019 and makes saving for retirement easier.

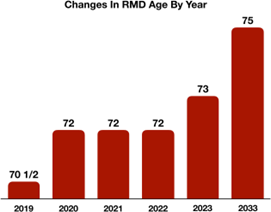

A major highlight of the Secure Act 2.0 is to increase the age at which required minimum distributions (RMDs) begin, allowing workers and retirees to leave funds in retirement accounts for longer, thus pushing off additional tax liability. In 2019, the RMD age was raised from 70½ years of age to 72. Now, the Secure Act 2.0 raises it to 73 beginning in 2023 and to 75 in 2033. These gradual changes are expected to accommodate and assist an incoming wave of baby boomers nearing retirement. With a few extra years before RMDs kick in, older workers have greater incentives to continue saving for retirement. Company- sponsored retirement plans will require automatic enrollments into 401(k) and 403(b) plans, whereas it is currently only optional for employers to do so. In these plans, employers must also set up a contribution rate between 3% and 10%, plus an automatic contribution increase of 1% annually until a range of 10% to 15% is met. This provision will go into effect beginning December 31, 2024.

Another key change introduced by the Secure Act 2.0 will be allowing employer contributions for student loan payments. This would allow employers to match contributions to employee retirement plans based on student loan payments, easing the journey of saving for retirement. In the case of an emergency, Secure Act 2.0 also allows for a penalty-free withdrawal of up to $1,000 a year versus a previous 10% early-withdrawal penalty for withdrawals made under the age of 59½. Secure Act

Another key change introduced by the Secure Act 2.0 will be allowing employer contributions for student loan payments. This would allow employers to match contributions to employee retirement plans based on student loan payments, easing the journey of saving for retirement. In the case of an emergency, Secure Act 2.0 also allows for a penalty-free withdrawal of up to $1,000 a year versus a previous 10% early-withdrawal penalty for withdrawals made under the age of 59½. Secure Act2.0 also raises the ceilings on catch-up payments made past the age of 50, with an emphasis on payments made between the ages of 60 and 63. (Sources: U.S. Congress; Internal Revenue Service)

Gas Prices Fall to an 18-Month Low – Oil Industry Update

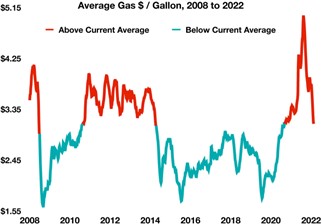

verage gasoline prices have officially reached an 18-month low after extraordinary prices in 2022. The average price per gallon of regular gasoline across the U.S. stood at $3.09 at the end of 2022, which was last seen over 18 months ago in June of 2021. In 2022, several international factors including supply limitations due to the war in Ukraine led to abnormally high fuel costs for consumers. The average price per gallon across the nation eclipsed $4 for 22 weeks in a row and surpassed $5 in June of 2022. Gasoline became a financial burden for many consumers

verage gasoline prices have officially reached an 18-month low after extraordinary prices in 2022. The average price per gallon of regular gasoline across the U.S. stood at $3.09 at the end of 2022, which was last seen over 18 months ago in June of 2021. In 2022, several international factors including supply limitations due to the war in Ukraine led to abnormally high fuel costs for consumers. The average price per gallon across the nation eclipsed $4 for 22 weeks in a row and surpassed $5 in June of 2022. Gasoline became a financial burden for many consumersthroughout 2022, compounding already higher prices for other essential items. (Sources: U.S. Energy Information Administration, Federal Reserve Bank of St. Louis)

The 12th Annual Bozeman CPA Symposium was another Triumph! A huge thank you to our amazing speakers, Brett Valentine (Delta Cybersecurity), Scott Holton (Next Frontier Partners), Scott MacFarlane (Gallatin County Commissioner) and Mariah Stopplecamp (MSU Accounting). It’s also the only happy hour CPE available anywhere.

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $5 to $30 Million. Go outside, we’ve got this.