Dear Friends,

My wife and I recently graduated our youngest child from High School and it was a great milestone for our family! Raising kids sure did fly by in a blink of an eye! Over that time I’ve made good and plenty of bad choices. In retrospect, I believe that it’s the actions that I did regularly, and for a long time, that have made the greatest impact on my quality of life today. Being a consistent parent, exercising a bunch with my wife, working everyday on my business, and investing regularly have made me wealthy in many ways. Historical studies of investment successes agree with what I’ve witnessed, that time in the market is far more important than when you buy. If only we had more time…

For those delaying an investment decision, putting money at risk should always make you nervous. But how long are you going to put life on hold to time things perfectly right?

For those delaying an investment decision, putting money at risk should always make you nervous. But how long are you going to put life on hold to time things perfectly right?

As always, the fears of today are different than yesterday. The list of recent market terrors that your portfolios have endured is substantial: pandemic, banking crisis (ongoing), a huge bond selloff (ongoing), a war in Ukraine (ongoing), and a political system with suspect morals. But In hindsight, most of these headline stories actually don’t have much of an impact on your financial! future. The US consumer and business owners are resilient, and the Federal Reserve continues to engineer a soft landing to our inflation problem.

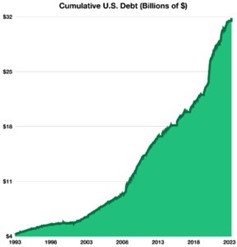

Living on borrowed time – the Scary Chart

The amount of debt we have taken on is not good and it does concern me. Paying it back will be difficult, and not paying it back is unfathomable. Congress passed legislation during last-minute negotiations to avert a default on the nation’s debt. It had to happen, but let’s not waste a chance to examine our debt situation. The suspension on the U.S. government’s $31.4 trillion debt ceiling is temporary until lawmakers finalize legislation to fund ongoing federal obligations. Translation, we are out of balance and it’s getting worse. But in the meantime, this additional money is already in the system is a big reason why the

The amount of debt we have taken on is not good and it does concern me. Paying it back will be difficult, and not paying it back is unfathomable. Congress passed legislation during last-minute negotiations to avert a default on the nation’s debt. It had to happen, but let’s not waste a chance to examine our debt situation. The suspension on the U.S. government’s $31.4 trillion debt ceiling is temporary until lawmakers finalize legislation to fund ongoing federal obligations. Translation, we are out of balance and it’s getting worse. But in the meantime, this additional money is already in the system is a big reason why theconsumer remains strong – for a while longer we think. (Sources: U.S. Congress, Treasury Dept., G7, Federal Reserve)

Equities Endure Volatility – Domestic & International Stock Markets

Uncertainty with the debt ceiling created volatility in domestic equities, yet still maintained positive year- to-date returns for the S&P 500 Index and the Nasdaq. The Dow Jones Industrial Average was still -0.72% for the year. Major international regional indices such as the MSCI EAFE, the MSCI Europe, the MSCI Pacific, and the MSCI Emerging Markets all maintained positive YTD results through the end of May. (Sources: Dow Jones, S&P, Nasdaq, MSCI, Bloomberg)

Debt Ceiling Issues Push Yields Higher – Fixed Income Overview

Government bond yields saw an increase in May as discussions surrounding the debt ceiling transpired. Even with the turmoil in May, all bond sectors were still posting positive year-to-date results as of the end of May. The yield on the 10-year Treasury bond settled at 3.64%, rising slightly as possible increasing costs of borrowing for the government prompted concerns. (Sources: Treasury, Bloomberg)

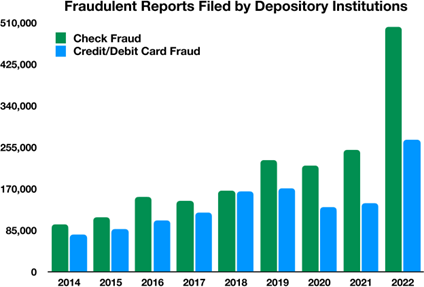

Paper Check Fraud On The Rise – Consumer Awareness

Despite electronic deposits and checks on the rise, paper checks remain an extremely common way to pay expenses such as rent, utilities, donations, and taxes. However, fraud is increasingly targeting paper checks, raising the risks of writing a check.

Such fraud can occur in a wide variety of ways, including the targeting of mailboxes where checks lay susceptible. Most of these tactics are low-tech and primarily target a more elderly population that still heavily relies on paper checks. Americans sent out 11.2 billion checks in 2021 alone. Banks are reporting that check fraud has been rising significantly, with credit card fraud the next highest form of fraud.

Certain methods could prevent check fraud. For one, individuals and businesses should limit the number of written checks to reduce the chances of a check being stolen. Experts recommend using gel ink pens rather than ballpoint pens to make it more difficult to remove the ink with chemicals. Additionally, always keep an eye on any unusual transactions and report them as soon as possible to your bank. (Sources: Financial Crimes Enforcement Network, Federal Reserve Bank of the U.S., U.S. Treasury Department)

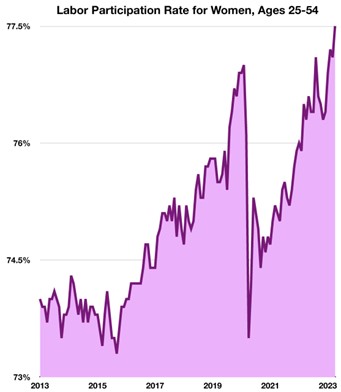

More Women in the Workforce – Labor Market Update

An increasing share of women are participating in the workforce, representing a strong recovery from a pandemic-era slump. With more job openings and recruitment of women alongside high inflation driving needs for supplemental income, more women than ever are either employed or searching for work.

This recovery has come quite swiftly from the sudden drop seen in the pandemic, as millions of women either lost their jobs or left the workforce. In the early months of the pandemic, the labor participation rate dropped by over 3.5%, reaching the lowest rate since 2015. The number of women in the workforce had been in a general decline since its peak in 2000, yet showed a sense of resurgence in the late 2010s leading up to the pandemic. Now, the labor participation rate for women between the ages of 25 and 54 is 77.5%, higher than ever recorded. As primarily younger women continuously enter the workforce with plans to work long- term, this rate is expected by many analysts to continue rising. (Sources: Organization for Economic Co-operation and Development. Federal Reserve Bank of St. Louis)

Economic Growth & Inflation Starting To Cool – Economic Environment

Also trending downward is inflation, increasing 4.9 percent from April 2022 to April 2023, the smallest 12- month increase since April 2021. A large driver behind this decline is the mellowing of more volatile factors such as electricity, gasoline, vehicles, and food. Leading this decline is the price of gasoline, which fell 17.4% in March and 12.2% in April from the year prior.

However, core inflation remains resilient. Core inflation excludes more volatile factors which significantly contributed to inflation’s historic rise in 2022. While lower than its September 2022 high of 6.6%, core inflation has remained relatively constant in the past 5 months, measuring in April at 5.5%, just 0.1% lower than in March and the same as in February. (Sources: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, Bureau of Economic Analysis)

Hot Tip – When I get asked how to find the best rates on CD’s I suggest visiting bankrate.com. The site is easy to use and seems to provide good information. I also always recommend that you talk with your local banker as well. Frequently a local bank can be competitive and also offer additional valuable services.

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $5 to $30 Million. Go outside, we’ve got this.