Dear Friends,

As of this writing, I haven’t gotten the virus yet (knock on wood, salt over shoulder, etc.), but I know a lot of good people that have. Somedays it feels like a game, other days it feels like a Twilight Zone episode. All days are a lesson in managing risk. And like investing, each decision is calculated, but uncertain. Some activities can be avoided, but living a life of purpose requires taking on at least some risk, even during normal times. One of the risks that I am willing to assume is continuing to donate my time to coach youth sports. This past Fall I helped out with the running club and this winter I hope to coach kids for BSF Nordic. Being around middle schoolers makes me laugh, and when they work hard as a team it’s magical. Hopefully we can pull it off safely!

As of this writing, I haven’t gotten the virus yet (knock on wood, salt over shoulder, etc.), but I know a lot of good people that have. Somedays it feels like a game, other days it feels like a Twilight Zone episode. All days are a lesson in managing risk. And like investing, each decision is calculated, but uncertain. Some activities can be avoided, but living a life of purpose requires taking on at least some risk, even during normal times. One of the risks that I am willing to assume is continuing to donate my time to coach youth sports. This past Fall I helped out with the running club and this winter I hope to coach kids for BSF Nordic. Being around middle schoolers makes me laugh, and when they work hard as a team it’s magical. Hopefully we can pull it off safely!

It’s Going to be OK – for those on the upper leg of the ‘K’

When economists talk about a ‘K’ shaped recovery, they mean that there are people on the lower leg who are really suffering, while others are doing just fine. COVID-19 has brought about possibly some of the largest shifts in consumer trends ever, as demand for online shopping, eating out, and energy consumption have dramatically changed in a matter of months. Gasoline usage cratered as electricity usage simultaneously soared, the result of millions of workers transitioning to home based offices. It sure seems that a vaccine is on its way, but many of these trends will persist. Against the backdrop of a changing political landscape there is much to be wary of.

We believe that over time stocks and real estate will continue their gains, somewhat irrespective of normal valuation metrics (e.g. stay expensive). Here are a few tips that might help you weather this long dark stretch on our way to the light: pay down debt rather than invest in bonds or CD’s. keep your retirement accounts exposed to stocks, and overweight your normal savings. The market has never been this high before, and that’s a good thing. It’s supposed to go up!

Cybersecurity is getting easier with password managers like ‘LastPass’. I’ve used the free version of this app and found it to work well. Imagine, only having to remember ONE password and having all of your payment information secure as well. Save yourself from a possible digital catastrophe and please make this a family effort over the holiday.

Sincere wishes of peace, health, and optimism.

-Mike

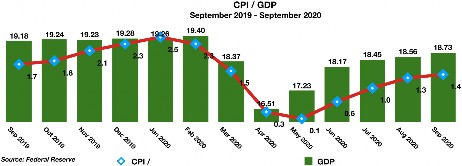

The dynamics of stagflation can diminish a person’s income as the cost of essential services and goods rise, while no wage increases occur. The textbook inflation years of the late 70s were different from what is occurring now, as there is no wage inflation today like there was in the 70s. As a result, a growing number of workers today are experiencing higher prices but with the same or less income.(Source: BEA)

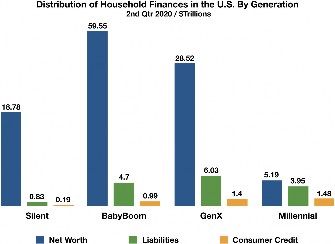

Millennials Lagging Relative To Their Parents & Grandparents – Demographics. The Federal Reserve tracks and compiles data on all of the generational members which include the Silent, Baby Boomer, Gen X, and Millennials. The data is revealing that the millennial generation, born between 1981 to 1996, are lacking in their finances. Fed data for the four generations shows that millennials have already accumulated nearly as much debt as Boomers and have the most use of consumer credit of all the generational groups. Millennials control just 4.6% of U.S. wealth even though they represent the largest segment of the U.S. workforce. Economists view that millennials are far behind their previous generations when it comes to finance and assets, creating anticipated financial struggles for millions.

Some credit the easy money policies enacted by the Fed as well as a robust economy for the decades that drove wealth for the GenXers and the Boomers. Millennials haven’t been as fortunate to have had economic tailwinds to push them along, making it that much more difficult to build wealth and establish themselves financially. (Sources: Federal Reserve Bank of St. Louis: Survey of Consumer Finances & Financial Accounts)

Some credit the easy money policies enacted by the Fed as well as a robust economy for the decades that drove wealth for the GenXers and the Boomers. Millennials haven’t been as fortunate to have had economic tailwinds to push them along, making it that much more difficult to build wealth and establish themselves financially. (Sources: Federal Reserve Bank of St. Louis: Survey of Consumer Finances & Financial Accounts)

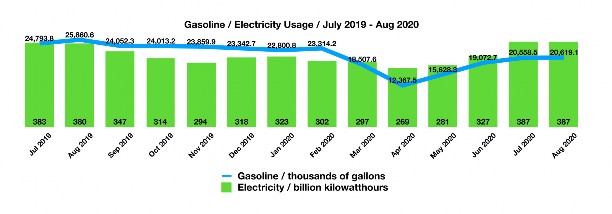

Pandemic Shifts What Energy We Are Using – Consumer Energy Usage. COVID-19 has upended and completely altered the way we use energy. What has been conventional wisdom and consistent for decades has all changed in a matter of months. For the first time since 1960, U.S. consumers have spent more on electricity than on gasoline, representing a dramatic shift in energy usage.

Reasons for the shift are attributed to an enormous drop in driving, as millions of U.S. workers began working from home. Demand for gasoline dropped to the lowest levels since 1990, in turn transferring demand to electricity which has seen the largest usage spike in 20 years. The growing use of laptops, printers and other home office equipment has elevated home electricity consumption. Any additional stay at home mandates may continue to affect gasoline and electricity consumption as millions of workers continue to adjust working from home.

Sources: U.S. Energy Information Administration

How Lower Credit Limits Affect Your Credit Score Due To The Pandemic – Personal Finance

Millions of Americans are having their credit scores adversely affected by the pandemic, as banks and finance companies modify the extension of credit. As consumers struggle to retain a fragile balance between joblessness, lower wages, and household expenses, lenders are cutting credit limits, lines of credit, and credit card charge limits. The result has been a reduction in scores for millions of Americans even though many continue to manage their credit and payments successfully.

Lenders have been reducing their risk of exposure since March by reducing credit limits on consumer accounts. Since many of these credit accounts carry a balance, the credit utilization ratio rises as a credit limit is reduced. This ratio is a critical component used by the three major credit reporting firms in determining a consumer’s credit score. As ratios rise because of a credit limit reduction, credit scores tend to drop. It is assumed that the higher the ratio, the greater the risk for lenders.

Consumers have been surprised by lower credit scores, since lenders are not obligated to warn customers about a pending credit limit reduction, but only do so after it has been done.

In order to try to curtail the effects of a higher utilization ratio, it is suggested that consumers contact their credit lenders directly and request a reinstatement of their prior credit limit. It is also suggested that simply paying down an existing balance may help in alleviating the threat of a credit score drop.

Source: Federal Reserve

Save up to $10,000 on your Montana Taxes with the Montana Endowment Tax Credit

Save up to $10,000 on your Montana Taxes with the Montana Endowment Tax Credit

What if there was a way to get up to a $10,000 credit on your taxes? What if by getting this credit, you’d not only benefit yourself but also benefit Montana? And what if Montana is one of just a few states to offer a credit like this?

Formally known as the Montana Charitable Endowment Tax Credit, this opportunity offers you a credit of 40% of a qualifying planned gift’s federal charitable deduction, up to a maximum of $10,000, per year, per individual. It also allows a credit of 20% of a gift’s federal charitable deduction for a direct gift by a qualified business up to a maximum of $10,000 per year.

*This is a complicated strategy that should involve careful consideration and review by your tax professionals to determine its suitability.

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $3 to $12 Million. Go outside, we’ve got this.