I believe that or country is, as a whole, economically strong and likely to stay that way for a while. From improving jobs and extra cash on hand to declining virus cases, the optimism of Springtime is here! It’s particularly encouraging to see people I care about getting their vaccinations and beginning to visit family and friends again. Recently, we were able to host our first grandparent visit in 13 months and it was great! I hope you and your loved ones are feeling some relief as we emerge from Winter, a bitter election, and hopefully the pandemic.

I just had a big birthday (not 40), and I’m feeling pretty good about things. When I reflect on the best investment lessons I’ve learned they may sound super boring: start early, don’t panic, diversify, and be cautious of the new stuff. To this list I will now add one that my youngest daughter has made popular in our family: be confident but don’t get cocky (Han Solo 1977). Virtually all investments have done well for the past 10 years. If you were confident in your investing, you likely participated in those gains. But if you recently found yourself becoming

I just had a big birthday (not 40), and I’m feeling pretty good about things. When I reflect on the best investment lessons I’ve learned they may sound super boring: start early, don’t panic, diversify, and be cautious of the new stuff. To this list I will now add one that my youngest daughter has made popular in our family: be confident but don’t get cocky (Han Solo 1977). Virtually all investments have done well for the past 10 years. If you were confident in your investing, you likely participated in those gains. But if you recently found yourself becoming

emboldened with some unique special powers of prediction, you may have found yourself on the other end of a ‘Gamestop’ experience. Age teaches us that there will be more opportunities to learn what we don’t know.

The one rate to rule them all-The 10 Year Treasury

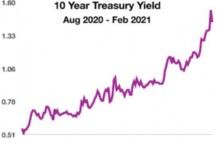

When people talk about rates, they usually mean the interest yeild of 10 year US Treasury Note, one of the benchmarks for loan rates worldwide. Historically, rising interest rates have been symbolic of improving economic activity while higher prices for goods and services are considered inflationary.

While we can’t see future challenges as clearly as we would like, many pundits are concerned about inflation. In this issue we explore how rising rates on the 10 year treasury are stoking inflation worries. Unlike the short term Federal Funds rate, the longer bonds are sold via auction, and the rate is purely subject to supply and demand. In recent auctions the rate of interest these bonds pay has adjusted upwards significantly, implying lower value, and this has impacts pretty much everywhere. For example, rising rates in February affected mortgage and various consumer loans as the yield on the 10-year Treasury bond surpassed 1.5%, nearly three times the yield from its low of 0.52% in August 2020. (Treasury, Fed)

While we can’t see future challenges as clearly as we would like, many pundits are concerned about inflation. In this issue we explore how rising rates on the 10 year treasury are stoking inflation worries. Unlike the short term Federal Funds rate, the longer bonds are sold via auction, and the rate is purely subject to supply and demand. In recent auctions the rate of interest these bonds pay has adjusted upwards significantly, implying lower value, and this has impacts pretty much everywhere. For example, rising rates in February affected mortgage and various consumer loans as the yield on the 10-year Treasury bond surpassed 1.5%, nearly three times the yield from its low of 0.52% in August 2020. (Treasury, Fed)

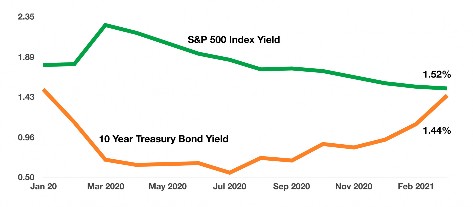

One of the key benefits investors enjoy is receiving dividends (distributions) from stocks and income (interest) from bonds. One of our strategies that has been working well is to focus more on owning stocks for dividends and appreciation. But we are closely watching the increase that bonds pay and their lower risk as well. The volatility in the bonds market last month was rough, as the prices on fixed income portfolios adjusted mostly lower. Higher rates cut both ways and rates and inflation still have a long way to go before they reach normal levels.

Despite a sell off in equity markets towards the end of February, equity indices managed to post a gain for the month, with energy and commodities leading.

A rapid rise in interest rates over the past few weeks elevated the yield on the 10-year U.S. Treasury bond to 1.60% in February, eclipsing the yield on the S&P 500 Index of 1.53%. When the yield on the 10-year Treasury surpasses that of the S&P 500 Index, it is known as an inflection point affecting further demand for stocks. (Sources: Treasury, Federal Reserve, Bloomberg)

A rapid rise in interest rates over the past few weeks elevated the yield on the 10-year U.S. Treasury bond to 1.60% in February, eclipsing the yield on the S&P 500 Index of 1.53%. When the yield on the 10-year Treasury surpasses that of the S&P 500 Index, it is known as an inflection point affecting further demand for stocks. (Sources: Treasury, Federal Reserve, Bloomberg)

Fed Continues To Stabilize Interest Rates By Buying Bonds – Fixed Income Overview

The Federal Reserve signaled that it would continue its ambitious program of buying $120 billion of treasury and mortgage bonds each month. The bond buying is meant to provide economic stimulus and stabilize interest rates.

Bond analysts believe that the Fed is distorting bond yields and prices by its ambitious buying of Treasury and mortgage bonds in the markets. Some argue that bond yields as well as inflationary expectations may actually be higher without any of the Federal Reserve’s supportive purchases of bonds. This is why markets are carefully monitoring Fed comments regarding continued bond purchases.

Mortgage rates and consumer loan rates rose in February as the yield on the 10-year Treasury bond reached 1.6% in trading during February. The rapid rise in yields has also affected other sectors of the bond market including municipals, corporate and mortgage backed securities. (Sources: Federal Reserve, U.S. Treasury)

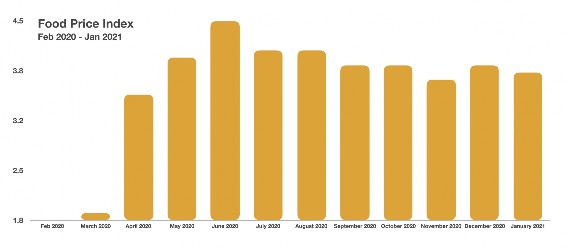

Food Prices On The Rise – Consumer Inflation

The price of food, from oranges to eggs to meat, increased at an annual rate of 3.9% in 2020 according to the Bureau of Labor Statistics. Prices are projected to increase 2-3% in 2021 as forecast by the U.S. Department of Agriculture. The 20-year historical average increase has been a 2.4% increase per year.

Of the various food items seeing higher prices, meat has been exhibiting the greatest increase. Causes behind the jump in meat prices have been packing plant disruptions due to the pandemic.

COVID-19 has also upended global food supply chains with delayed transportation and a lack of workers that have fallen ill to COVID-19. Rising commodity prices such as corn and wheat have added to higher feed costs for cattle, chickens and hogs worldwide, three of the largest meat products. Severe weather in various continents has devastated feed crops and created shortages in addition to pandemic related challenges. (Sources: UN Food & Agriculture Organization, U.S.D.A., BLS, U.S. department of Agriculture)

From the Good News Department – Where Has The Flu Gone This Season ?

With the focus on COVID-19 and the daily updates surrounding the case count for the coronavirus, many have forgotten about the decades old flu, also known as the influenza virus. Surprisingly enough, the flu has nearly vanished this flu season, with reports of flu cases the lowest in decades. February saw one of the lowest case counts of flu cases ever, even though the Centers for Disease Control and Prevention (CDC) says that February has historically been the peak of almost all prior flu seasons.

Medical experts believe that measures put in place to fend off the coronavirus may have also fended off the flu virus. Mask wearing, social distancing, working from home, and virtual schooling have all helped prevent the spread of both COVID-19 and the flu. Flu cases have also been at record low levels globally, including in China, Europe, South Africa and Australia.

The CDC estimates that of the 190 million flu vaccines distributed this season, the infection rates are so low that it makes it very difficult to determine which flu strains are actually circulating and infecting people. Data for the 2020-2021 flu season haven’t been compiled yet by the CDC due to the lack of flu related cases. (Source: Centers for Disease Control and Prevention)

Taxpayer Scam During Tax Time – Consumer Tax Awareness

The IRS has issued an alert regarding scam phone calls directly to taxpayers nationwide. The calls may be in person or via ‘robocalls’. Scammers claim that delinquent taxes are owed and that payment must be made or the taxpayer’s social security number will be suspended or canceled. The IRS advises that when in doubt, immediately hang up and ignore the call.

Taxpayers should not disclose any sensitive information to unknown callers, including social security numbers, bank accounts, age, birthdate or formal name. For information regarding any taxes owed as well as the authenticity of an unknown call, the IRS recommends you call them directly at 800.829.1040. (Source: IRS.gov)

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $3 to $12 Million. Go outside, we’ve got this.