Dear Friends,

I hope you have enjoyed a terrific start to 2022 and that you enjoy great health, wealth and happiness in your home this year. The United States is STILL the best country to live, work and play in and while Bozeman is no longer a secret, it’s growing with nice people. Let us all jump into the new year with a positive attitude- let’s go ’22!

No one predicted that this would be our future. A year after Covid-19 changed the course of travel, socialization, and financial markets, 2021 witnessed a much quicker rebound than had been anticipated. The equity market upswing caught many by surprise as it was not anticipated. I hope you all benefited greatly. If you are a client of ours, you did.

No one predicted that this would be our future. A year after Covid-19 changed the course of travel, socialization, and financial markets, 2021 witnessed a much quicker rebound than had been anticipated. The equity market upswing caught many by surprise as it was not anticipated. I hope you all benefited greatly. If you are a client of ours, you did.

Looking forward, there are plenty of concerns that we are studying. Inflation brought about by supply constraints and rising labor costs are expected to linger well into 2022, with little abatement as underlying inflationary pressures persist. Labor shortages triggered by the pandemic continue into 2022, leading to wage inflation and difficulty for employers filling over 10 million open positions nationwide. Workers are quitting their jobs at record levels, transitioning to higher paying positions and new occupations.

As your advisors, these newsy items are things that we deal with on a regular basis and don’t get too excited about. Managing your money through these times is our job and our expertise. There are, however, some trends that we spend more time focusing on than others – possible forces that are larger and persistent in scale. For example, in this issue we highlight some population trends for the US. For the first time ever, immigrants surpassed the number of births for the past census year which ended in July 2021. Population growth was driven by 245,000 entrants into the country, versus only 148,000 births. We believe that

As your advisors, these newsy items are things that we deal with on a regular basis and don’t get too excited about. Managing your money through these times is our job and our expertise. There are, however, some trends that we spend more time focusing on than others – possible forces that are larger and persistent in scale. For example, in this issue we highlight some population trends for the US. For the first time ever, immigrants surpassed the number of births for the past census year which ended in July 2021. Population growth was driven by 245,000 entrants into the country, versus only 148,000 births. We believe thatdemographics matter when projecting our role in the global economy. Sources: Federal Reserve, Census Bureau, CDC, Labor Dept., Treasury Dept.

Enjoy the reading and let us know if we can help you or someone you know find financial peace of mind.

-Mike

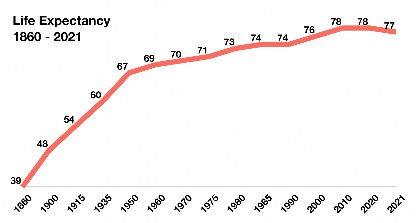

Life Expectancy Drops – Demographics

Recently released data by the Center of Disease Control and Prevention reveal that life expectancy in the U.S. declined by 1.8 years in 2020. The three leading causes of death in 2020 were heart disease, cancer and Covid-19. Life expectancy for all Americans in 2019 was 78.8 years falling to 77 years in 2020. Those aged 85 and older saw the most deaths, many experiencing medical complications from Covid-19. In 2020, Covid related deaths exceeded deaths caused by strokes, Alzheimers, diabetes, and kidney disease.

The U.S. Department of Health & Human Services tracks factors contributing to life expectancy including age, gender and race. The most recent data revealed that females are estimated to live to age 81 while males are expected to live to 76, a five year difference. Just remember, most people do not experience ‘the average’ outcome!

The U.S. Department of Health & Human Services tracks factors contributing to life expectancy including age, gender and race. The most recent data revealed that females are estimated to live to age 81 while males are expected to live to 76, a five year difference. Just remember, most people do not experience ‘the average’ outcome!(Sources: U.S. Department of Health & Human Services, CDC)

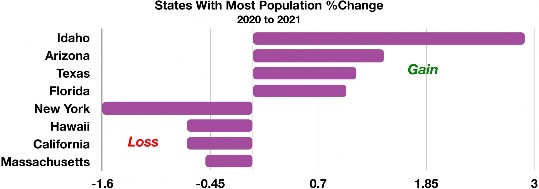

States That Lost & Gained Population During The Pandemic – Lifestyle Trends

As Covid infections swept the nation in 2020 and 2021, states differed on restrictions and guidance surrounding the pandemic, encouraging many to migrate to another state.

Health, jobs, housing and quality of life were all factors in influencing Americans to leave for other states. Deaths and births were also a factor in states’ population growth and declines, yet not as significant as migration.

From 2020 to 2021, Idaho, Texas and Florida were among the states that saw the largest population increases, while New York, California, and Massachusetts were among states with the most declines. (Source: U.S. Census Bureau)

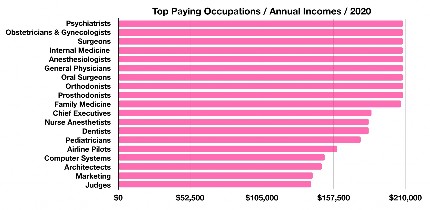

Medical Positions Represent Highest Paying Jobs Heading Into 2022 – Labor Market Overview

The U.S. Bureau of Labor Statistics compiles pay on occupations across various industries and has found that 14 of the nation’s top 20 paying occupations are in the medical field. Psychiatrists, surgeons, and anesthesiologists top the pay list along with airline pilots and chief executives.

Advancements in medical technology as well as changing demographics have created a growing demand for medical specialists and general practitioners. Medical industry positions can be either part of a private practice or hospital / medical group. (Source: Bureau of Labor Statistics)

Advancements in medical technology as well as changing demographics have created a growing demand for medical specialists and general practitioners. Medical industry positions can be either part of a private practice or hospital / medical group. (Source: Bureau of Labor Statistics)Over $1 Trillion Paid Out In Social Security Benefits In 2021 – Retirement Planning

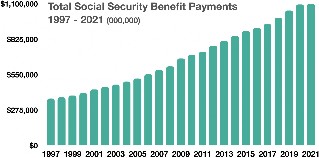

As of November 2021, over 69.9 million Americans received Social Security benefit payments, with over 51 million age 65 or older. The Social Security Administration estimates that Americans received over $1 trillion in Social Security benefit payments in 2021. Total annual benefit payments have nearly tripled in the past 13 years, up from $361 billion in 1997.

In 1940, the life expectancy of a 65-year old was 14 years, today it’s about 20 years. By 2036 there will be almost twice as many older Americans eligible for benefits as today, from 41.9 million to 78.1 million. Even the current drop in life expectancy to 77 years of age is not estimated to affect current projections much.

The latest annual report issued by the trustees of Social Security and Medicare revealed that by 2034, the program’s trust fund will be depleted. Depletion means that Social Security recipients will no longer be receiving full scheduled benefits. Recipients would receive about three-quarters of their scheduled benefits after 2034. Congress can eventually act to fortify the program’s finances, but it may be years before it actually takes effect and funds.

Social Security’s largest costs are attributable to Medicare, which represents over 76% of

Social Security’s largest costs are attributable to Medicare, which represents over 76% of

Social Security benefits. The report also mentioned that Medicare’s hospital insurance fund would be depleted in 2026. The trustees noted that the aging population of the country has placed additional pressure on both the Social

Security and Medicare programs. The Social Security Administration considers various factors in projecting its estimates, including fertility, immigration, wages, health, and economic growth. (Sources: https://www.ssa.gov/oact/TR/2019/index.html)

The 12th Annual Bozeman CPA Symposium was super fab! Last October we hosted over 50 local CPA’s (distanced) for 4 hours of continuing education that got rave reviews! Top notch speakers delivered thoughtful and actionable information on: managing generational differences in the workspace, how to do more to protect Seniors from fraud, and 2 great sessions on estate planning. One of our speakers, Dr. Marsha Goetting, happens to have a digital library of resources that cover much of what was discussed and it’s available to everyone! https://www.montana.edu/familyeconomics/

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $5 to $30 Million. Go outside, we’ve got this.