After almost 6 months and counting, the pandemic has created a new ‘normal’ for all of us. Mostly, we are doing less – less haircuts, less dinner out, less travel, less group sports, less happy-hours, less seeing friends …. It is having an effect and no one is immune from moments of frustration and pessimism. What helps is the telephone. When used in it’s originally intended form, studies are pretty clear that the human voice can provide connections that text and email do not. So please, think of those you may suspect are feeling down and let them hear your voice. Our local suicide hotline is busy, and it’s something that McCormick Financial Advisors is proud to support (see calendar on the back for info on their Oct 31st fundraiser).

The pandemic is a global problem and still quite scary. This is not localized like a hurricane, or a war, or a famine. This is everyone at once changing behaviors for a period of time. As the economic patterns emerge, we will likely see lasting damage to portions of our economy such as: travel, office space, and most things entertainment. We also are witnessing new opportunities and solutions-the lifeblood of capitalism. These trends may not reverse for some time, and even long-term investors should take a good look at what they own. We are.

The Inflation Question – Both real estate and stock markets are reaching new highs, when maybe they shouldn’t be. One reason for this is straightforward: The US Middle Class has extra money and there are few places to put it other than their 401ks and their homes, and so prices go up. The recent stimulus actions of the Fed and Treasury were about 3 times the size of what occurred during the Great Recession, only 12 years ago. Tragically, for many this money is spent immediately on necessities and falls short. But for those that were able to rebuild and succeed in the last 10-year bull market, this extra money is just that, extra.

When too much money chases too few goods we have inflation. Some inflation is needed to stimulate activity, but too much inflation means that the US may be reaching its global credit limit. The Federal Reserve has added about $1.8T into the economy since March. In contrast, GDP for the second quarter ending June 30th, dropped by $2.1T (an annualized growth rate of -32.9%, the lowest quarterly drop on record). Federalreserve.gov

Fortunately, the USA has the credit to keep its borrowing costs low, and to maintain a strong dollar. And since the Pandemic is affecting every other economy on the planet, our relative credit ranking is still strong. For example, the economic slowdown has been more prevalent in Europe, where GDP within the EU fell by over 48% on an annualized basis. The USA is still a wonderful place to be, and to invest. Give us a call if you care to hear our thoughts about these changing times. 406-522-3201. No login needed!

I wish you health and peace. And thank you for doing your part to help, serve, fund, pray, and smile. This too shall pass.

Resilient Equity Market Advances – Domestic Equities Update

Equities shrugged off the shortest Bear market in history and have advanced to new highs, led by the technology sector, which has remained resilient since the onset of the pandemic. The dollar’s tumble in July benefited large U.S. multinationals, whose products and services became more competitive while their earnings are primarily driven in the overseas market. The rebound in stocks from the lows of March, when the COVID-19 pandemic became official, has exceeded the expectations of both analysts and economists.

A consistent low-rate environment along with a weaker U.S. dollar bodes well for U.S. multinational companies, whose profits benefit from both low rates and a weak dollar. U.S. exports essentially become cheaper overseas, driving higher demand. (Sources: Bloomberg, Reuters, FRED)

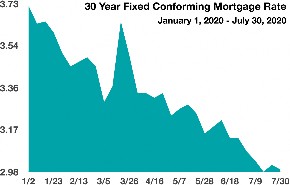

30 Year Mortgage Rates Drop to Record Lows – Fixed Income Overview

Continued low rates drove mortgage rates to their lowest levels ever, pushing the average 30-year fixed conforming rate to 2.99% in July as reported by Freddie Mac. Historic low mortgage rates are a buffer for the housing market, where continued high employment is expected to hinder loan approvals.

U.S. government bond yields fell across all maturities in July, with the benchmark 10year Treasury yield reaching 0.55% and the 30-year Treasury yield falling to 1.20%. Economists view the higher yielding longterm bonds as a normal yield curve, indicating some inflationary expectations and future economic growth. (Sources: Freddie Mac, Bloomberg, U.S. Treasury)

U.S. government bond yields fell across all maturities in July, with the benchmark 10year Treasury yield reaching 0.55% and the 30-year Treasury yield falling to 1.20%. Economists view the higher yielding longterm bonds as a normal yield curve, indicating some inflationary expectations and future economic growth. (Sources: Freddie Mac, Bloomberg, U.S. Treasury)

Mortgage rates going up? A new “Adverse Market” fee of 0.5%

Fannie Mae and Freddie Mac are planning to charge an additional fee on most mortgage refinance loans that could raise costs for borrowers trying to take advantage of historically low rates in an uncertain economy.

The mortgage giants, which have been under government control since 2008, announced the plan recently, saying the new 0.5% fee is meant to mitigate their risk in light of the Covid-19 pandemic. It would apply to most refinances involving the companies. The move is viewed as part of an overall effort to separate the mortgage agencies from government ties. Potential investors will want to know how Fannie and Freddie can offload risk—or offset it with earnings, including fees. (Sources: WSJ, Bloomberg)

Rates Stabilize In June – Fixed Income Overview

Federal Reserve buying of debt securities continued in the second quarter under the Secondary Market Corporate Credit Facility program, which was established to maintain liquidity in the bond markets. Individual corporate bonds and ETFs have been part of the Fed’s buying program, which was launched in mid-June. Bonds purchased so far include debt issues from both investment grade and non-investment grade rated companies.

Corporate and government bonds continued to post positive returns in the second quarter, as yields stabilized following the dramatic drop in yields during the first quarter of the year. The benchmark 10-year Treasury bond yield closed at 0.66% at the end of June, helping to boost consumer lending and mortgage rates. (Sources: Treasury Dept., Federal Reserve, Bloomberg)

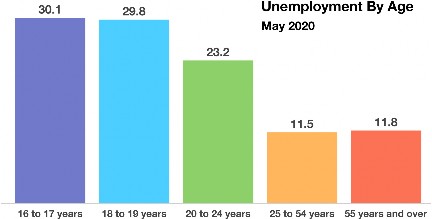

Unemployment Hits Young Workers Hardest – Labor Market Overview

Unemployment has hit younger workers the hardest, with roughly 25% of workers ages 16 to 24 losing their jobs from February to May due to the virus outbreak. Traditional sectors employing mostly younger workers, such as leisure, hospitality, and restaurants, have suffered dramatic drops in business activity since the outbreak.

Current conditions brought about by the pandemic have made it even more challenging for high school and college students, as well as graduates, to find short term and summer job positions.

Current conditions brought about by the pandemic have made it even more challenging for high school and college students, as well as graduates, to find short term and summer job positions.

Younger workers 16-19 years of age are experiencing unemployment rates as high as 30%, more than double the rate this same time last year. Teenagers are seeing nearly triple the amount of unemployed compared to all other age groups nationally, which is 11.1% unemployment as of the most recent data reported by the Department of Labor. (Sources: DOL, BLS)

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $3 to $12 Million. Go outside, we’ve got this.