Dear Friends,

Our oldest daughter recently graduated from high school and it was a fantastic celebration, with hugs and smiles once again. Congratulations to the class of 2021! Milestones like these are mostly all about the graduate, but it’s hard not to recognize that these are milestones for us parents too, marking the passage of time in our own individual lives. It’s a sudden jolt of reality reminding us that this life is finite and the time we have left is truly our most precious resource. Nothing matters more than how we choose to spend it. Our money is only a tool to facilitate those choices and, like most tools, your financial decisions are able to both benefit and harm your life’s plan. We are here to help.

The pandemic passing marks another Milestone, hopefully (knock on wood!). We all endured discomfort, we all suffered disappointments and inconveniences. But thanks to everyone doing their part, we can now all celebrate our collective graduation from isolation and restrictions, Yahoo! The joyful smiles at gatherings I’ve been seeing everywhere are infectious and triumphant! And the true thanks go to those that did the real work (which is still being done) by our first responders and essential workers (Teachers!). We can’t thank them enough for making a much larger sacrifice on behalf of the rest of us.In this newsletter we cover a variety of topics important to your money. From College 529 plans to looming inflation threats, we believe that all endeavours perform better with more planning and action. If only the pandemic could have actually stopped time instead of just warped it!

The pandemic passing marks another Milestone, hopefully (knock on wood!). We all endured discomfort, we all suffered disappointments and inconveniences. But thanks to everyone doing their part, we can now all celebrate our collective graduation from isolation and restrictions, Yahoo! The joyful smiles at gatherings I’ve been seeing everywhere are infectious and triumphant! And the true thanks go to those that did the real work (which is still being done) by our first responders and essential workers (Teachers!). We can’t thank them enough for making a much larger sacrifice on behalf of the rest of us.In this newsletter we cover a variety of topics important to your money. From College 529 plans to looming inflation threats, we believe that all endeavours perform better with more planning and action. If only the pandemic could have actually stopped time instead of just warped it!

On the Road Again

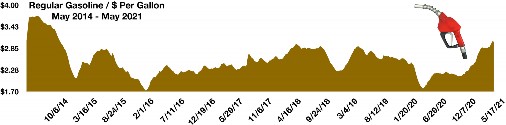

Top on everyone’s post-pandemic list is to get back to traveling and guess what, prices have gone up. An increase in travel has spurred higher fuel costs for airlines and automobiles as pent up demand and the summer months propel prices higher. The average cost for a gallon of regular gasoline rose above $3 per gallon nationally in May, the highest since 2014. Crude oil prices, which directly affect the price of gasoline, have risen over 80% in the past year. (Sources: FBI, Federal Reserve, EIA, Dept. of Labor)

Travel Picks Up – Travel & Leisure

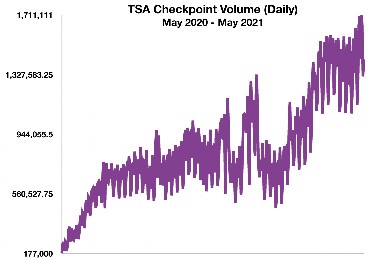

The proliferation of vaccinations, along with pent up demand for travel has driven Americans to finally leave home and head out. The Transportation Security Administration (TSA) essentially tracks and counts every traveler passing through a TSA security checkpoint in every airport nationwide. The compiled data over the past year shows a dramatic downturn in travel in May 2020 with just over 176,000 daily travellers versus 1,500,000 daily travellers in May 2021.

The U.S. Energy Information Administration (EIA) is expecting U.S. highway travel to rise by 15% this summer, from last summer.The EIA also forecasts that consumers will increase their spending on motor gasoline by about 31% this summer due to increased travel as the pandemic subsides. Source: https://www.tsa.gov/

The U.S. Energy Information Administration (EIA) is expecting U.S. highway travel to rise by 15% this summer, from last summer.The EIA also forecasts that consumers will increase their spending on motor gasoline by about 31% this summer due to increased travel as the pandemic subsides. Source: https://www.tsa.gov/

What To Do With That Unused Travel Budget – Financial Planning

As millions of Americans stayed home during the pandemic and traveled nowhere as hotels, resorts, and restaurants closed, budgets created for travel and vacation went idle. Many are still deterred, if not discouraged, to travel in fear of another virus outbreak or simply out of paranoia. Travel has become a bit more complicated and burdensome, especially for the elderly who just don’t travel as easily as during their younger years.

With inflation the topic of concern, higher educational costs are an issue for recent grads. A consideration might be to migrate some of the idle funds in the travel budget to a grandchild’s college saving’s plan, such as a 529. Named after the IRS Code it falls under, Section 529 plans have amassed over $425 billion in assets since their inception in 1997. Their popularity soared over the years as parents and grandparents realized their favorable tax benefits while also saving for college expenses. These plans offer two primary benefits: assets grow tax deferred and come out tax free for qualified expenses; and, contributions made by parents and grandparents are considered a gift, thus proving a tax benefit for some contributors. Over the years, both wealthy and lower-income parents and grandparents have been the main contributors to these plans.

Any parent or grandparent can make gifts of up to $15,000 per year per individual person (child) and to as many individuals as they wish. Section 529 plans allow gifts to be made five years ahead all at once. Thus, a grandparent can gift $75,000 per grandchild at once for the next five years. If the grandparent has five grandchildren, then they have the ability to contribute $375,000 at once to the 529 plans, which are considered gifts. There would be no gift tax, assuming no other gifts were made to that child over those years. This is a strategy for parents and grandparents that may have estates valued at over $11.7 million, the current federal estate tax exemption level. (Source: www.irs.gov/businesses/small-businesses-self- employed/estate-tax)

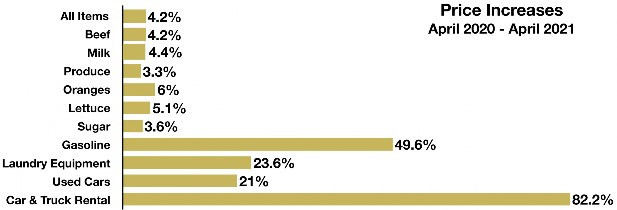

How Inflation Creeps Up On Consumers – Consumer Behavior

Over the past year, global economies went from a slow expansion at the beginning of 2020, to an abrupt halt with the onset of the pandemic in March 2020. Supply chain bottlenecks have become rampant as increasing demand has evolved from a slowly recovering global economy. Historically, rising producer prices have been a predecessor to consumer inflation when manufacturers and distributors pass along the higher cost of materials and labor to consumers in the form of higher retail prices. A lack of critical components for everything from automobiles to cellular phones brought about production shortages that led to decreases in supply simultaneously as demand fell across the globe. As demand has begun to rekindle, shuttered factories and supply chains have not been able to keep up with rising demand, resulting in order backlogs and higher prices. (Source: Bureau of Economic Analysis)

USPS Struggling – Government Agency Overview

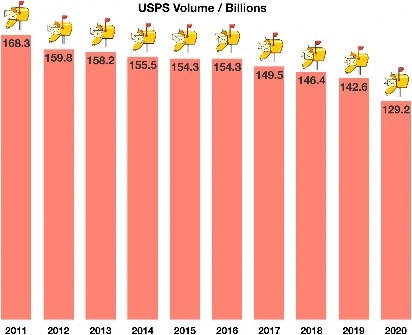

The United States Postal Service (USPS) remains an integral part of the economy and the country’s infrastructure even as the popularity of electronic payments and digital transactions have dramatically reduced the volume of mail processed by the USPS.

Of the more than 129 billion pieces of mail delivered in 2020, the most widely used service of the USPS is its first class mail service. As the volume of all mail has been dwindling, so has first class mail, falling from over 103 billion pieces in 2000 to just over 52 billion pieces in 2020, roughly a 50% drop in twenty years. There have been numerous rate increases over the years, with the most recent rate increase up to 55 cents for a 1 ounce letter in January 2019. Source: USPS

The Bozeman CPA Symposium is on for November 10th, 2021 at the Gran Tree! If you are an accounting professional, look for a registration announcement later this summer. As always, we have a great lineup of engaging speakers (CPE available) and a happy hour to boot!

And for everyone– Among other great traditions that have returned, the monthly Bozeman 5k Brew Runs are back and, well, running! Check out the schedule and register at https:// www.bozemanrunningcompany.com/ 5k-brew-run-series.html

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $3 to $12 Million. Go outside, we’ve got this.