Dear Friends,

We just experienced a market selloff that was triggered by too much money in the system and runaway prices on most everything. The stock market bubble popped so hard that US Companies have seen ~$10 Trillion of value taken off their stock prices in just a few months. For most investors this means that their portfolio is now back to January 2021 valuations or even earlier.

We just experienced a market selloff that was triggered by too much money in the system and runaway prices on most everything. The stock market bubble popped so hard that US Companies have seen ~$10 Trillion of value taken off their stock prices in just a few months. For most investors this means that their portfolio is now back to January 2021 valuations or even earlier.

This is how the market has been treating investors recently- harshly. Two years ago when the pandemic hit we lost ~40% in a week and two years before that in 2018 there was an 18% drop due to the taper tantrum. However, despite these selloffs, the S&P 500 has an annual 5-year return of +11% (as of this writing)! Enduring these scary times and the news that conflate it is the price investors pay for the growth the market provides.

I’m not discounting that we don’t have significant issues to solve before we get back to the races (we do and that’s what the rest of the newsletter is for). But while the challenges we face are new, this is normal stock market volatility. I believe we are below a fair value and for clients with surplus cash flows we are selectively putting money to work – prudently.

Surviving Inflation

While long term investors are accomplished at not putting too much importance on the day to day value of their accounts, ignoring inflation is another matter. Every day we pay more for the same goods and services than we did in the past. I can remember in the late 1970s taking a dollar to the 7-11 and walking out with 4 Full-Sized Candy Bars! (I did in-fact get a stomach ache). Higher prices are everywhere today and we experience that reality all day long. This is a great opportunity to sit down and analyze your own personal budget. Your credit card will offer you an online spending report that details where it all went. Print it out and look it over with your spouse. Make a goal of terminating a few recurring bills and to reduce spending in one category. Then, make sure the savings go into something you can use tomorrow to help keep up with inflation and keep your plan on track!

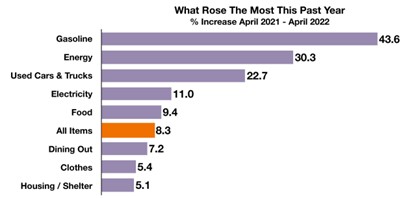

What’s Risen The Most – Tracking Inflation

Energy and fuel were among the top contributors to inflation this past year, with used cars, electricity and food all enhancing the tensions surrounding inflation.

Transportation costs have become a growing contributor to inflation, as the vast majority of food, produce, and basic consumer goods are transported using gasoline and diesel. The summer months are expected to be especially challenging for shippers and consumers, as the historically demanding summer months

Transportation costs have become a growing contributor to inflation, as the vast majority of food, produce, and basic consumer goods are transported using gasoline and diesel. The summer months are expected to be especially challenging for shippers and consumers, as the historically demanding summer monthsdrive fuel prices even higher. Optimistically, the enormous rise in inventories is expected to ease inflation over the next few months, as an over supply of materials and finished products are expected to fall in price. (Sources: EIA, BLS, Labor Dept.)

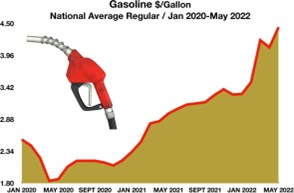

Gasoline Prices Expected To Head Higher This Summer – Energy Overview

Various factors are contributing to sustained high gas prices, which are expected to add to price pressures heading into the summer months. Traditionally, gasoline prices move higher as vacation travelers hit the road during the summer months. Transportation companies, railroads, and airlines also see enhanced activity during the summer season. This summer, however, may produce exceptional prices, as continued supply constraints, shipping issues, and increased international demand for U.S. oil and gasoline driven by the Russian invasion of Ukraine. The EIA reported that the average price of a gallon of regular gasoline rose to over $4.00 in May for all 50 states, the first time ever.

Rising gasoline prices can become a burden for both consumers and companies. Not only are consumers spending more of their income on fuel, companies also pass along the higher costs of fuel to consumers.

Higher fuel prices tend to filter down to the consumer since the cost of food, transportation, and travel are

all affected by rising fuel expenses.

There is also the prospect of lower fuel prices. Historically, rising fuel prices eventually hinder economic growth, thus slowing industrial and consumer activity and lessening demand for fuel. Many economists believe that a recession would also curtail demand for fuel, thus bringing fuel prices lower.

There is also the prospect of lower fuel prices. Historically, rising fuel prices eventually hinder economic growth, thus slowing industrial and consumer activity and lessening demand for fuel. Many economists believe that a recession would also curtail demand for fuel, thus bringing fuel prices lower.

Source: U.S. Energy Information Administration (EIA)

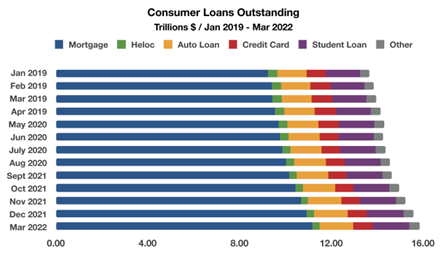

Credit Usage Heading Higher – Consumer Credit

As pandemic assistance funds vanish, consumers are turning to savings and credit to pay for essentials. With many consumers having exhausted their cash reserves, credit becomes an option. Consumers have been tapping into savings accumulated from pandemic stimulus funds in order to keep up with inflation.

Even though overall wages have risen roughly 6% over the past year according to Labor Department data, the increases are still not enough to keep up with inflation running at over 8%. As households start to experience shortfalls, many resort to credit in order to meet month to month expenses.

Auto loans and credit card debt have seen the largest usage increases as tracked by the Federal Reserve over the past few months. Mortgage debt has also risen, but mostly at the upper end of the credit score scale. Credit scores on newly originated mortgages remain relatively high, reflecting continuing high lending standards by

Auto loans and credit card debt have seen the largest usage increases as tracked by the Federal Reserve over the past few months. Mortgage debt has also risen, but mostly at the upper end of the credit score scale. Credit scores on newly originated mortgages remain relatively high, reflecting continuing high lending standards bylenders. The median credit score of newly originated mortgages was 776 during the first quarter of 2022. Analysts also believe that median credit scores may possibly begin to fall as consumers tap credit cards and exhaust their cash savings. (Sources: Labor Department, Federal Reserve Bank of New York; Household Debt and Credit Report (Q1 2022)

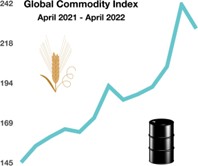

Global Commodity Prices May Be Signaling That Inflation Is Taming – Commodities Market Update

As heightened commodity prices have stoked inflation over the past year, commodity prices worldwide are now starting to ease as demand for various commodities are alleviating.

The Global Price Index of All Commodities tracks the price of widely traded commodities, including copper, wheat, gold, lumber, and sugar. Broad commodity prices retracted in April after reaching record levels in March, with building and manufacturing related commodities seeing the largest drop. Simultaneously, food related commodities have continued to see rising prices over the past two months. Historically, a drop in building materials is indicative of a broader slow down in economic activity, as home builders and manufacturers prepare for an expected drop in demand. As commodity prices ease, so does inflation, which is a result of the manufacturing industry

The Global Price Index of All Commodities tracks the price of widely traded commodities, including copper, wheat, gold, lumber, and sugar. Broad commodity prices retracted in April after reaching record levels in March, with building and manufacturing related commodities seeing the largest drop. Simultaneously, food related commodities have continued to see rising prices over the past two months. Historically, a drop in building materials is indicative of a broader slow down in economic activity, as home builders and manufacturers prepare for an expected drop in demand. As commodity prices ease, so does inflation, which is a result of the manufacturing industryreigning in prices and trying to stay competitive.(Sources: International Monetary Fund, Global Price Index of All Commodities [PALLFNFINDEXQ], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PALLFNFINDEXQ, June 7, 2022)

We are here to help you and the people you care about! I regularly field calls from referred friends and associates, helping them navigate questions about money. Part of my practice is designed to help people that are not clients of ours. These are tricky times and everyone can benefit from a second opinion or another viewpoint on a tricky financial decision. It’s not sales, it’s people helping people. 406-920-1682.

About Us

Our clients enjoy the feeling of having their financial lives kept in order. Freedom from worry comes from working with an experienced advisor that understands your entire financial life and is accessible and attentive to your needs. As a fiduciary, Mike is unable to receive commissions from financial products and free to make recommendations that are unbiased by Wall Street. With over a decade of experience caring for a small family of clients, our specialties are preserving wealth and generating sustainable income. Our average client net worth ranges from $5 to $30 Million. Go outside, we’ve got this.